Summary

- The company saw its first positive quarterly net asset inflows since 2017.

- Taking steps to expand into fast growing Active Non-Transparent ETFs.

- The company has become the subject of renewed merger speculation.

Thesis

After falling to a decade low in May, Invesco Ltd. (IVZ) stock has been rallying. Although some of the rise may be due to the market’s post-pandemic bounce, some positive company specific factors may also be at play. Since reaching its low, the company saw its first positive quarterly net asset inflows since 2017, it has taken steps to expand into fast growing Active Non-Transparent ETFs, and in the last couple of months it has become the subject of renewed merger speculation. It’s likely that these factors will continue fueling Invesco’s stock price in the months to come.

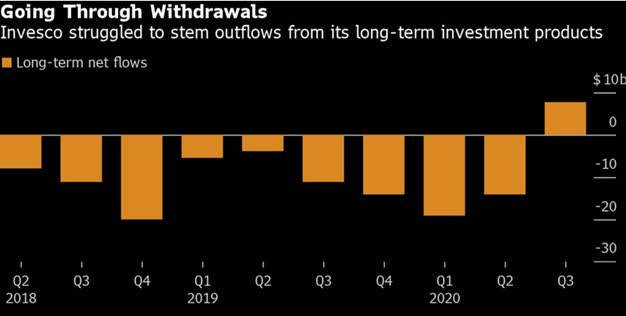

Increase in Long-Term Net Flows

Although takeover news may be getting all the headlines, of potentially longer-term significance was the news that Invesco had net Q3 asset inflows, the first quarterly long-term net inflows since the stock began its precipitous decline in Q1 2018. Granted, this was only one quarter and it remains to be seen whether or not a new trend is beginning; but if the company is shifting from constant quarterly outflows to sustained inflows, the stock should continue to respond in kind.

Of interest is also the mix of assets managed by the company and how that asset mix has changed in recent years. In the just-ended third quarter, the company had $1.2 trillion in AUM of which $900 billion was actively managed and $318 billion was passive, or just under 27%. One would want to see that number grow given investors for most of the last decade have been moving into passive and leaving active management behind. The reported numbers are a 6% improvement from where they stood at the end of Q4 2017, just before the stock began its prolonged slide the company had $199 billion of its $938 billion of AUM in passive products which came to a 21% share. Upon first glance the topline numbers may appear to be disappointing given that in recent years industry leader BlackRock Inc. (BLK) has had up to 65% of its AUM in its index and ETF businesses.

However, if we dig deeper to focus on the equity portion, leaving fixed income aside, we begin to see deeper changes taking place as $258 billion of the firm’s $592 billion in equity funds was passive which amounts to a respectable 44%. That’s a 14% increase from where the number stood at the end of 2017 when only 30% of their equity AUM was in passive.