Summary

- FleetCor has been doing better than expected under COVID; sequential improvements and pockets of growth were visible in Q3 results.

- Management has continued to deploy cash productively, with more share buybacks and the $450m AFEX acquisition in the quarter.

- With shares largely moving only sideways in the last few months, FleetCor trades at a 21.1x P/E and a 4.3% FCF Yield on 2019 financials.

- We continue to believe FleetCor can achieve a sustainable double-digit EPS growth and re-rate upwards after the end of the COVID outbreak.

- At $260.30, including a return to a 25x P/E, shares can deliver a total return of 52% (14.3% annualised) by 2023 year-end. Buy.

Introduction

We review our investment case on FleetCor (FLT) 5 months after our initiation with a Buy rating in July, taking into account recent developments including the release of Q3 2020 results on November 5.

Since our initiation, FLT shares have gained only 2.9%, underperforming the S&P 500 by approx. 10 ppt. With the end of the COVID-19 outbreak finally in sight, we believe FLT is on track to deliver an upside of more than 50% by 2023 year end.

Buy Case Recap

Our Buy case assumed that the quality of FLT's businesses meant its earnings growth and valuation multiple would both recover after COVID-19:

- We believe FLT's payment businesses have strong network effects, revenue models that offer strong growth potential, good operational leverage and are deeply integrated into their customers' business processes

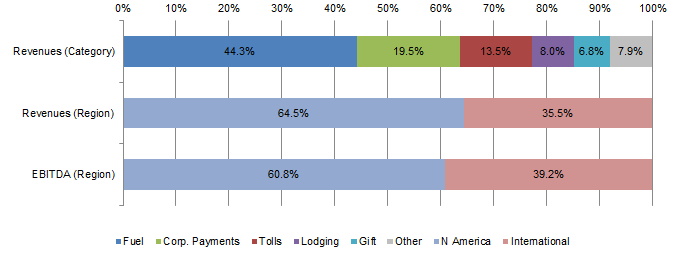

- We believe FLT can achieve a long-term structural revenue CAGR of approx. 6%, including 5%+ for Fuel, 15% for Corporate Payments, 10% for Tolls (in US dollars), and zero for Lodging

FLT Revenue & EBITDA Breakdown (2019) (Pre-COVID) Source: FLT 10-K (2019). Source: FLT 10-K (2019). |

- Including operational leverage, with a margin uplift of 20-50 bps each year, we believe long-term EBITDA CAGR would be 6.5-7.0%; including buybacks, we believe long-term FCF Per Share CAGR would be 11%

- Because of COVID-19, we assumed FCF Per Share to decline by 27.5% in 2020, based on a revenue decline of 20% in Q2-Q4 (and 15% for the full year), but to be substantially back to 2019 levels in 2021.

- We assumed FLT shares would re-rate back upwards after COVID-19, with Free Cash Flow ("FCF") Yield returning to 4% (equivalent to a 23x P/E), the middle of its historic range before the outbreak.

- We assumed other external factors, including the FTC lawsuit against FLT's Fuel business and long-term macro trends (especially fuel prices) to be relatively benign, or at least have limited impact.

FLT's financial results since our initiation have been better than we expected, and we believe our investment case is on track, as we will explain below.

Better-Than-Expected Results & Visible Improvements

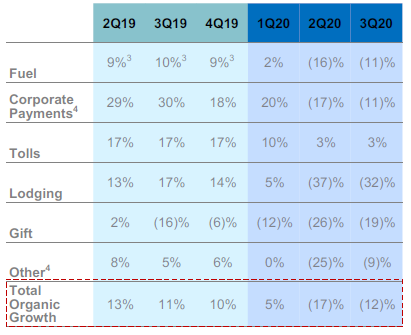

FleetCor has been doing better than expected during COVID-19. Where we had assumed a 20% year-on-year organic revenue decline through Q2-4 of 2020, actual revenue declines were 17% in Q2 and 12% in Q3:

FLT Organic Revenue Growth by Segment (Last 6 Quarters) Source: FLT results presentation (Q3 2020). Source: FLT results presentation (Q3 2020). |

As shown above, for most segments, while year-on-year growth was still negative in Q3, the quarter showed a clear sequential improvement; the one exception was Tolls, which had a positive 3% growth in both Q2 and Q3.