Summary

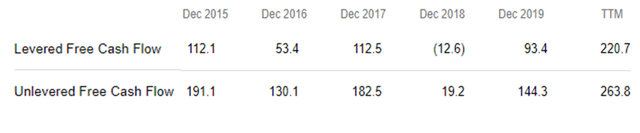

- I previously covered why Cumulus Media is an undervalued cash flow machine.

- Since then, they have executed several expected transactions that have improved their liquidity and lowered their financing cost.

- The share price is still low, but as management continues to execute and the economy recovers, they will be able to realize their value through buybacks.

- The stock remains a strong buy.

During the lockdown in March, I originally covered micro-cap Cumulus Media (NASDAQ:CMLS). They are a media company that owns over 400 stations and distributes podcast content. They have partnerships with figures like political personality Ben Shapiro, whose podcast is consistently a top 5 most downloaded podcast each month. They also have many sports personalities like former NFL players Michael Bennet and Pat McAfee.

Their stock price and valuation are depressed as sentiment for radio is very negative because it is often seen as an older, less relevant media format compared to Spotify (SPOT) or other streaming services. However, as my original article outlines, the data shows that radio listenership has actually been very resilient over the past decade. Cumulus and other radio companies have a history of consistent cash flow generation, even if they are challenged in the short term by COVID.

Source: Seeking Alpha

In the long term, radio only faces a very gradual decline, giving Cumulus plenty of time to shift content and production efforts into podcasts and digital content, which they have already had success doing.

Although they will permanently lose out on some advertising revenue because of the negative effects COVID has on advertising spending and event businesses, they still have the same potential to create cash in a normal economy. The only threat would be a short-term cash crunch. Cumulus was able to sell non-core real estate for $66 million in net proceeds. They also entered into a sale-leaseback transaction for $202 million in net proceeds - effectively a cheaper form of financing than the bonds they have outstanding. These transactions give them more than enough liquidity for the rest of the pandemic.

As of their recently reported Q3 earnings and subsequent transactions, they have about $300 million in cash on their balance sheet. They don't have any debt maturities until 2026 and their net debt is only 3.5x their regular EBITDA (before COVID). Although EBITDA is lower during the pandemic, they still reported positive adjusted EBITDA each quarter this year. The interest on their debt was $16 million in Q3 and will be ~$1M less each quarter after a post-Q3 debt repurchase. That is less than the $20 million of adjusted EBITDA reported for the same quarter. In addition, the $300M in cash on hand provides a large buffer of safety.