Summary

- KO is on the verge of a break out.

- With its fundamentals pointing to higher earnings, I think it is a buy.

- The stock is pricing in historical growth levels, but I believe it will do much better than that.

Drinks maker Coca-Cola (KO) has been performing quite well of late. The stock took a fair bit of punishment earlier this year, and while that was certainly warranted given the conditions, it appears to me the recovery is visible enough to support the buying we’ve seen of late.

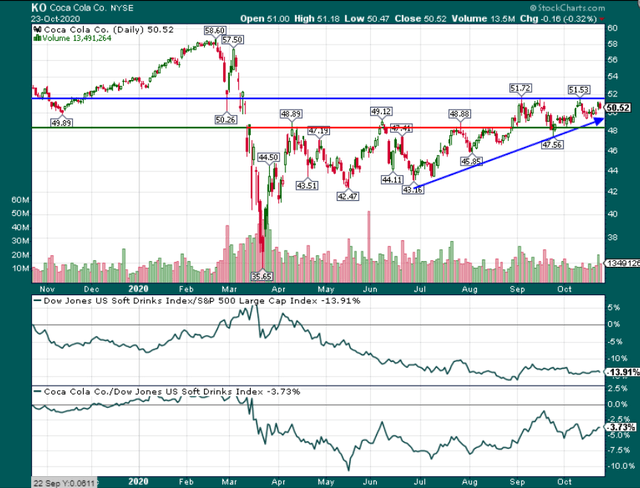

I’ve annotated this chart much more than I normally do because I firmly believe we’re seeing a breakout forming.

If we look at the period of June to late August, we can see that the stock formed an ascending triangle, with the top of it being around $48/$49. The breakout occurred in late August and shares ran up to ~$52. There’s been a period of consolidation since then, but if we look at the very right side of the chart, we can see another ascending triangle forming.

There is trendline support (blue arrow) that has been holding since the late June bottom, and higher lows have been made in recent weeks. While there may be one or two more connect points with the trendline, I firmly believe we’re about to see Coca-Cola break out above the $52 level and make a run at pre-pandemic highs.

The good news is that if the ascending triangle pattern fails, there is strong support at the former breakout level of ~$48, which is also annotated above. Therefore, I think you’ve got some pretty clearly defined parameters for this one and you’ll know fairly soon if the break out is occurring or not.