Summary

- Truist was created from a recent mega-merger and trades at less than book value despite sound and improving fundamentals.

- The regional bank maintains more than $500 billion in assets, has a $56 billion market cap, and yields an attractive 4.3%.

- We dissect its performance during the crisis, pinpoint key risks, and explore why the merger really took place.

- I do much more than just articles at iREIT on Alpha: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

- This article was coproduced with Williams Equity Research (WER).

You know how certain brands and businesses are simply part of your life? You utilize them every day or every week, taking for granted that they’ll always be there for you – because they are.

I’m talking about your local grocery store, the Hershey bar you buy on your way through the checkout line…

Or the bank branch you stop at on your way home.

Today, I'm going to provide readers with one of my personal "hometown favorites." Truist Financial Corporation (TFC) is a pick I think about almost daily since I'm a customer. Though that’s not the only reason why I’m writing about it right now.

When possible, we like to time articles to coincide with critical information releases that give subscribers an extra edge. Perhaps something like the release of Q3-20 earnings.

Williams Equity Research has carefully tracked the regional bank space for opportunity throughout 2020. Those efforts led to Cullen/Frost Bankers, Inc (CFR) late last month. WER purchased shares at just over $62, and the stock last closed at $68.67.

Our target entry point remains $60.50.

(Source)

So what has he uncovered this time? Let’s explore Truist and see everything it has to offer.

Truist Financial’s History and Current Structure

Cullen/Frost is focused exclusively in Texas and runs a very traditional business. Truist Financial, however, is moderately more complex and nationally diversified.

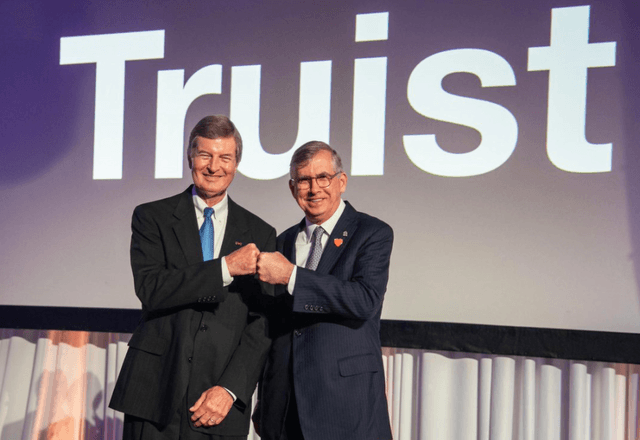

If you haven't heard of it before, that may be because it was formed when BB&T and SunTrust combined last December. That was a $66 billion all-stock transaction and the largest bank merger or acquisition that year.

As a result, we need to be more resourceful than normal to understand Truist at a deep level.

For instance, its filings prior to the merger are actually BB&T's. From a risk perspective, studying them showed it performed in line with or better than its regional bank peer averages. And, in terms of exposure to different types of commercial and consumer loans, it was similar to the combined entity.

Meanwhile, SunTrust maintains its old branding and online infrastructure, with the link to its investor relations simply jumping to Truist's. Fortunately, there's a "Legacy Documents" section that organizes its old filings.

That’s exceptionally important, since understanding both previous companies’ pasts determines our conclusion about their combined strength and weaknesses.