Summary

- BXC's GMs have been improving sequentially.

- BXC's management has been bringing down the bank-related debt by monetizing their real-estate portfolio and working capital improvements.

- Housing starts have stalled, lumber prices & future building permits have dropped, and the stock is close to resistance.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

The overall risk aversion environment means that these prices aren't being priced correctly.- John Cairns

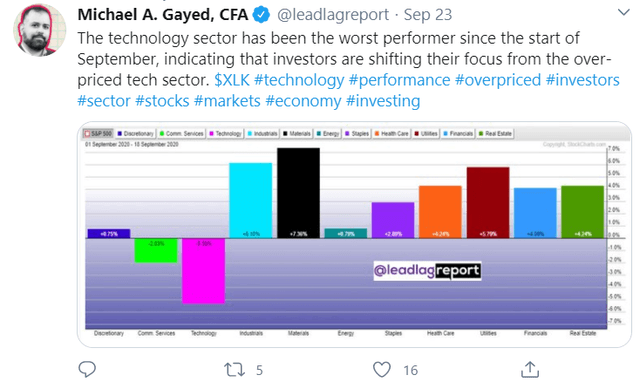

Whilst providing a compendium of the sectoral performance in The Lead-Lag Report, I had highlighted how badly tech had fared this month; conversely, at the other end of the spectrum, the materials and industrials segments have been the leaders of the pack. My article today focuses on an industrials & building materials stock - BlueLinx Holdings Inc. (BXC).

BXC distributes building and industrial materials across the U.S.; they distribute under two principal categories- Structural products (33% of annual sales) and Specialty products (67% of annual sales). Structural products are those used primarily for structural support, and walls in construction projects, such as rebar, remesh, plywood, lumber, and spruce. Their Specialty products segment is more high-margin and includes engineered wood products, cedar, siding, molding, metal products, and insulation.

Here are some of the key themes related to the BXC stock-

1) Gross margin (GM) progression

I've been enthused by how the company's GMs have been progressing over time. In fact, in the recently concluded Q2, GMs hit record levels of 14.4%, up 110bps YoY, and 35bps QoQ.

Source: BXC

This was driven mainly by the improvement in the high-margin Specialty segment where margins rose by +140bps YoY and +90bps QoQ (In the chart you can see that this has been improving sequentially for the last 5 quarters). Insofar as it is possible to have discretionary pricing power in a commoditized space, on a relative basis, the prospects of this are more prevalent in the Specialty vertical, than the Structural vertical (where price realizations are extremely sensitive to commodity prices). Structural margins declined sequentially in Q2 (still up +160bps YoY) on account of low commodity prices in April. Given how strong some of the structural product prices have been, especially lumber, for the first two months of Q3, I would expect BXC's Structural Product GMs to trend up sequentially for Q3.