Summary

- Recent restructuring sets up future cost saving.

- Flooring manufacturer will benefit from both new construction and DIY projects.

- Sizable insider ownership provides support for long-term strategy.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Changes in consumer preferences can also affect profits. So can the actions of our government. ? Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America's Wealthy

In times of turmoil, the winners who emerge are often those who adapt the best to changing times. For companies, this can involve a large restructuring to better position the company going forward. One such restructuring was recently undertaken by Mohawk Industries, Inc. (NYSE:MHK).

MHK is the world’s largest flooring manufacturer. Just under 60% of sales in the previous fiscal year were in the United States, with 25% in Europe and the rest across various other countries. Demand for the company’s products did decrease in the spring before starting to return into the summer.

Recent restructuring

Addressing the slump in demand, MHK undertook a large restructuring initiative during the second quarter. Headcount was lowered, assets were rationalized, and products were reduced. The restructuring is estimated to cost around $170 million (of which $44 million is cash cost) as it is completed over the next year.

Annual savings from the restructuring are estimated to be $110 to $120 million, which will pay off in the coming years. I applaud efforts to get ahead of changing consumer preferences and take swift action in the face of uncertainty. Furthermore, with most retail and manufacturing sites now re-opened, and various global government stimulus packages in place, MHK is well positioned for the future.

Second-quarter results

The restructuring was announced with second-quarter earnings, where weaker demand lowered net sales 21% year over year to $2,050 million. The reported loss for the quarter was $48 million. Adjusted net earnings were $26 million, excluding restructuring, acquisition, and other charges.

MHK raised over $1 billion through the issuance of new 7- and 10-year senior bonds in May and June 2020. As a result, MHK generated roughly $500 million of free cash flow during the quarter. MHK has a favorable maturity profile with no large debt maturities in 2020, and manageable amounts maturing over the following three years.

Insider ownership

One unique aspect of MHK is the large insider ownership with CEO Jeffrey Lorberbaum owning around 13% of the stock. Lorberbaum’s father founded Aladdin Mills, a bath mats company, that MHK later acquired. Lorberbaum eventually took over as CEO of MHK and grew the company into what it is today. In this case, I view the insider ownership as a positive, providing good long-term leadership for the company.

Valuation

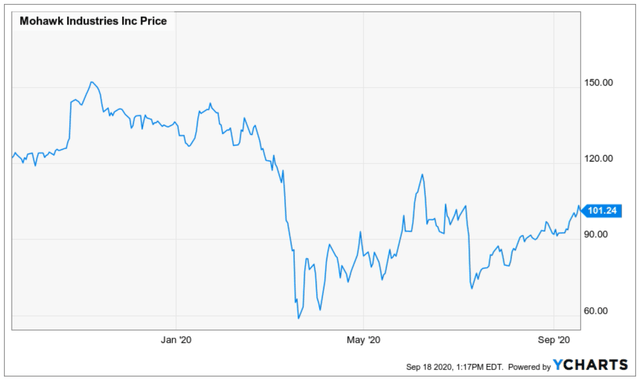

MHK currently trades at a PE ratio of 15.5x; in our opinion, a good value. Currently, MHK does not pay a dividend. The stock has been on an upward trend since announcing the restructuring with second-quarter earnings on August 6th, but remains lower than it was priced earlier this year.

Risks to ownership

- Prolonged levels of high unemployment or an economic downturn with depressed consumer spending could hurt future demand for the company’s products. However, I think the worst is behind us, and demand for housing-related products has been one area consumers continue to spend on.