Summary

- Coca-Cola's underlying momentum numbers have jumped nicely the last week of trading.

- Friday's reorganization announcement will help lower total operating expense as a percent of revenue next year.

- The main catalyst for ownership is a sharply lower dollar value in late 2020 should support overseas operations, already generating 70%+ of total 2019 sales.

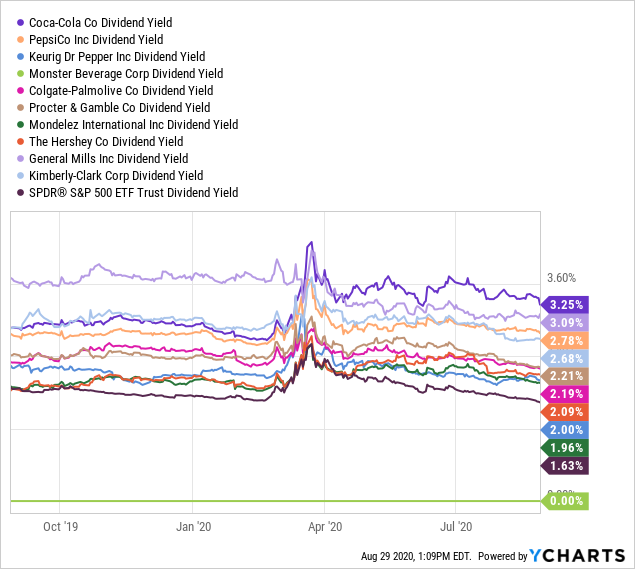

- Coke's 3.25% dividend yield is double the S&P 500 rate, and well above the competing cash distributions from comparable consumer staples.

On Friday, Coca-Cola (KO) announced a restructuring move, with as many as 4,000 employee positions cut, about 5% of its workforce. The stock market quickly voted its approval with a share price jump to 5-month highs. And, the sharp equity quote increase last week put the stock above its 200-day moving average for the first time since early March.

Image Source: Company Website

Image Source: Company Website

I was fortunate to buy Coca-Cola shares under $38 a share near the pandemic peak in fear during March. I posted a bullish story on the company around the same time here. Coke remains a top defensive play, especially if you are worried about the general market’s clear overvaluation and its logical drag on long-term returns going forward.

Dividend Too Good To Pass Up?

The primary argument for ownership is Coke’s high dividend yield vs. immediate beverage peers, other high profit margin, large-cap consumer staples, and the S&P 500 index average. The good news is Friday's cost-cutting announcement should make the dividend cover from profits and cash flow even safer. Below you can review Coca-Cola’s high 3.25% cash distribution annually against PepsiCo (PEP), Keurig Dr. Pepper (KDP), Monster Beverage (MNST), Colgate-Palmolive (CL), Proctor & Gamble (PG), Mondelez (MDLZ), Hershey (HSY), General Mills (GIS) and Kimberly-Clark (KMB), plus the S&P 500 index.

The 10-year growth in payouts is also near the top of the list of blue-chip peers. Below is a comparison graph of the difference in dividend raises the last decade, out of the equities with a long-term record of cash distributions. Coke’s 86% payout increase, better than 6% annualized, was quadruple the same period Consumer Price Index advance.