Summary

- Newell shares have struggled for years following a failed acquisition, but the business is improving.

- Q2 masked this improvement as lockdowns caused widespread sales declines.

- Core sales have been improving sequentially, the company has been gaining market share in some products, and cash flow is much improved.

- Having substantially strengthened its balance sheet since 2017, Newell is better prepared for this crisis.

At 10x free cash flow, shares are attractive.

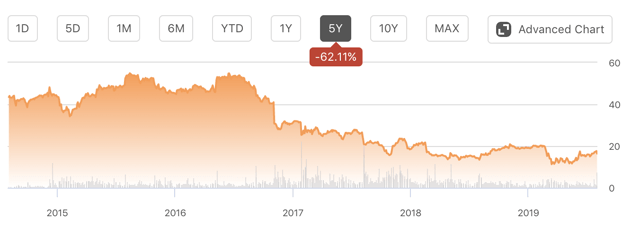

While Newell Brands (NWL) shares are up nearly 16% over the past year, they have been a poor performer over a longer time frame, having shed 62% of their value over 5 years. Its debt-laden acquisition of Jarden caused significant operating issues, forcing the company to sell down assets, pay off debt, and shrink operations. It now looks like the business is stabilizing, and shares are reasonably valued.

(Source: SEEKING ALPHA)

Q2 Results Were Impacted By Lockdowns

In the company’s second quarter (financials available here), Newell earned $0.30, $0.12 ahead of consensus as revenue beat by $80 million at $2.11 billion. Given lockdowns, revenue was 14.9% lower than a year ago. Core sales were down 12.6%. EPS was down 30% from last year given lower revenue and margin degradation.

Normalized operating margins were 10.2% v 12.2% a year ago, even though the company managed to reduced SG&A expenses by 20.3% to $488 million. As a consequence, operating income was $215 v $303 million a year ago. While about 75% of the business occurs inside of North America, the stronger dollar was a clear headwind for the business, costing it about $49 billion, or over 2% of sales.

As you can see below, each business unit saw a decline in net sales from last year, in part due to currency movement. Retail store closures and lockdowns also exacerbated the problems. However, there was a material divergence among the company’s five segments.