Summary

When the 180-day IPO lockup period for CDLX expires, pre-IPO shareholders and company insiders will be able to sell large blocks of previously-restricted shares for the first time.

We believe that pre-IPO shareholders and company insiders will be eager to sell - CDLX has a return from IPO of 58.6%.

Aggressive, risk-tolerant investors should short shares of CDLX ahead of the IPO lockup expiration.

This idea was first discussed with members of my private investing community, IPO Insights. To get an exclusive 'first look' at my best ideas, start your free trial today >>

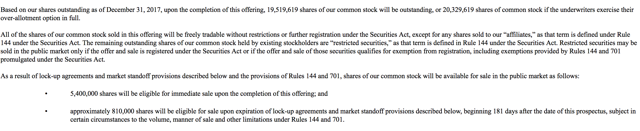

The 180-day lockup period for Cardlytics Inc. (CDLX) ends on August 31st, 2018. When this period concludes, the company’s pre-IPO shareholders have the opportunity to sell large blocks of currently-restricted securities. The potential for a sudden increase in the volume of shares traded on the secondary market could negatively impact the stock price of CDLX in the short term when the IPO lockup expires.

Currently, CDLX trades in the $20 to $21, significantly higher than its IPO price of $13. CDLX had a first day return of 2.8%. Since IPO, shares have climbed steadily to reach $18.82 on February 23, but they dropped to $13.41 on April 27. CDLX has a return from IPO of 58.6%.