Thesis summary

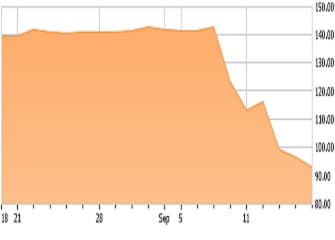

Equifax's (NYSE:EFX) data breach is not a run-of-the-mill credit card theft case. Social security numbers of almost all adult U.S. voters have been stolen. The company could face several surcharges over the typical fines and faces a risk of a politically motivated fine that could be high enough to liquidate the company. The valuation is not attractive enough yet to warrant these risks. The stock is not a safe short either. Its P/E has a lot of room to catch up to peers if the penalty outcome is benign.

This is the most serious security breach in corporate history

Let’s face it, Equifax is a hard-to-value stock right now. First, the legal costs from the massive security breach are hard to estimate, then there is reputational damage and its impact on future revenue and profit growth potential which may be making the current seemingly attractive forward P/E irrelevant, and then there is poor corporate governance risk stemming from insider stock sales before the public had a chance and a possible questionable stock buyback at a time when the company should conserve every cent.