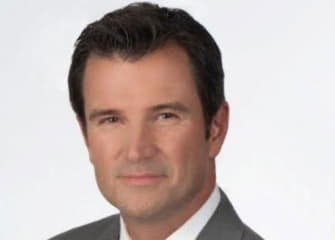

Charles (Chuck) Hodges II, Jones Day

The global law firm Jones Day has announced the arrival of Charles (Chuck) Hodges II to the Tax Practice in the Firm’s Atlanta Office.

A tax litigator for nearly 20 years, Mr. Hodges focuses his practice on civil and criminal federal tax cases and complex tax planning, with a particular attention to the taxation of intellectual property. He has litigated or advised on more than 125 cases concerning all areas of tax law against the Internal Revenue Service and state revenue agencies.

"Chuck has a wide-ranging and compelling record as a tax litigator,” said Edward T. Kennedy, Co-Leader of Jones Day’s Tax Practice. “He has represented clients against the IRS in U.S. Tax Court cases relating to the value of intellectual property, the deductibility or capitalization of expenses, employee retirement plan issues, the implications of tax-deferred mergers, and complicated estate matters. His experience will benefit Jones Day clients not just in Atlanta, but throughout the world.”

Mr. Hodges has represented a broad range of taxpayers including Fortune 500 companies, large privately-held companies, high-net worth individuals and their family offices, estates, and tax-exempt organizations. In tax disputes, Mr. Hodges’ experience allows him to both manage administrative proceedings and effectively litigate in the courtroom. He also has extensive experience working with tax issues resulting from the importation of products to the U.S., and has represented clients against the U.S. Customs & Border Protection and other government agencies during disputes related to import activities.

“Chuck is an exceptional addition to our Tax Practice with substantial trial experience in complex matters,” said Richard H. Deane Jr., Partner-in-Charge of Jones Day’s Atlanta office. “In particular, his experience with intellectual property tax issues makes him a valuable addition to our team. We are very happy he is joining the Firm.”

Mr. Hodges has represented taxpayers in many different federal courts, including among others, the U.S. Tax Court, the U.S. District Court for the Northern District of Georgia, and the U.S. Court of Appeals for the Fifth, Sixth, Ninth, and Eleventh Circuits.

Since 2005, Mr. Hodges has been listed as a "Leader in the Field" for Taxation by Chambers USA: America's Leading Lawyers for Business. He has authored numerous articles on tax matters and is a regular speaker on tax issues at industry conferences and seminars

Jones Day is a global law firm with 44 offices in major centers of business and finance throughout the world. Its unique governance system fosters an unparalleled level of integration and contributes to its perennial ranking as among the best in the world in client service. Jones Day provides significant legal representation for almost half of the Fortune 500, Fortune Global 500, and FT Global 500. The Atlanta Office of Jones Day proudly traces its roots back to 1890. As part of a full-service office that has steadily grown to its present size of about 130 lawyers, Jones Day's Atlanta attorneys advise clients on the full range of issues relevant to leading corporations doing business in the southeastern United States and worldwide.